Many types of insurance policies renew on a regular basis, providing insurers the opportunity to increase rates, change provisions or drop clients. Insurance companies often introduce new underwriting classes and plan rate schedules to offer new clients different premiums without changing current clients' rates. Some of these rate changes could offer you lower premium payments, but you have to apply for a new policy to get it. Many insurance companies pay a commission to the agent who wrote the initial policy, so many servicing agents will see if product changes could save new clients money on their existing coverage.

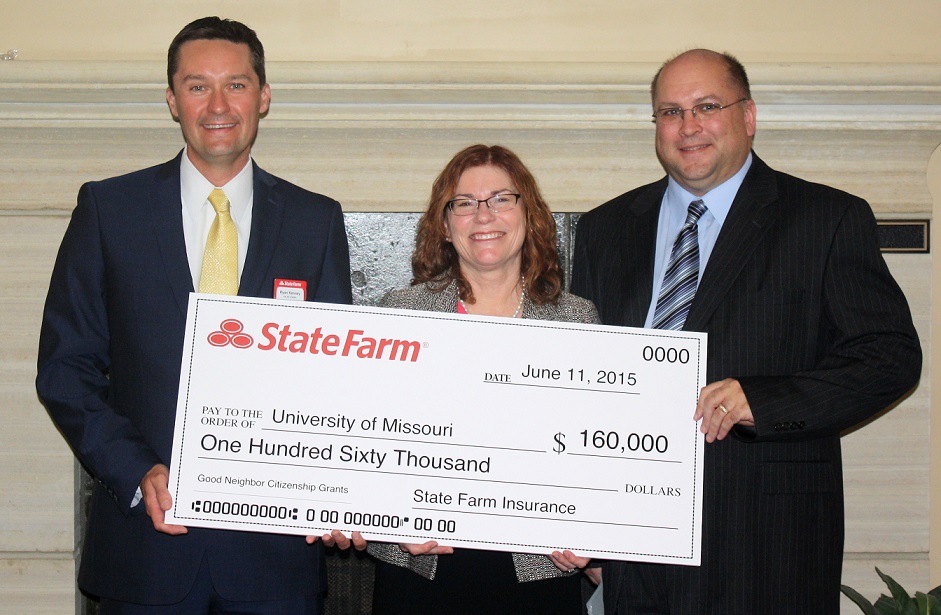

Saving a client money on existing coverage is an easy way for an agent to write a new policy. Or traffic violations should take special care to shop around for auto insurance policies. State Farm was founded in June 1922 by retired farmer George J. Mecherle as a mutual automobile insurance company owned by its policyholders. The firm specialized in auto insurance for farmers and later expanded services into other types of insurance, such as homeowners and life insurance, and then to banking and financial services.

We compared average auto insurance rates by company, location, age and gender, vehicle make and model, accident history, DUI record, credit score and marital status. Explore how much car insurance costs considering each factor. Because of the complexity of the products, most states prohibit insurance companies from negotiating rates on a customer-by-customer basis. Rates are set based on classes of underwriting risk, so two agents at the same company quoting rates for the same policy at the same time will wind up with the same premium. While this helps protect less-knowledgeable customers, it also prevents customers from getting agents to compete with each other on price. Our son recently bought a home in our same state, got offers for Umbrella coverage, home and two automobiles, the coverage we have.

We have been with State Farm more than 35 years, and his quotes are approximately $800 less per year for the total for the same coverage. There is a term for it, but companies penalize those of us who do not check. The only concern would be whether there is a sizable upcharge for a claim with the new company. These differences in rates do not hold true in all states, however.

The following states preclude insurers from using gender when setting auto insurance rates. This means that male and female drivers in the state will pay the same amount for car insurance in those locations if all other factors affecting rates are equal. One thing to keep in mind is that insurance companies are splitting the sales part of the company from the claims part of the company. In other words, your agent is there to sell, actual service will come from another part of the company. The days of the agent going to bat for you in the claims process is disappearing. The only time I ever had an auto claim was six years ago, the agent's assistant gave me the toll free number to call, the agent didn't return my call.

You should shop around for insurance at least every 2 years. If you find a better deal go with it even if it is not at the end of your policy. You will likely find a better deal because many insurance companies have teaser rates to get new business.

If this happens, just tell your nice insurance agent, you will probably be back with her in a year or two when you shop around again. I've had some insurance agents who understand the game to be very cordial and I continue to do business with them. Those agents do not have the opportunity for my insurance business going forward. In my case, I picked franchising because of the support Brightway provides me as an independent agent.

Prior to joining Brightway, I used to be a captive agent for another insurance carrier. This means I could sell policies for only one insurance company. While I enjoyed that, I wanted to own my own business and make decisions about my future. And, with a Brightway agency, I can sell policies from twice as many companies as my independent agent counterparts.

State Farm Change Agent Phone Number Given the different rating methodologies and factors used by insurers, no single insurance company will be best for everyone. To better understand your typical car insurance cost, spend some time comparing quotes across companies with your chosen method. Some Business Owners policies are underwritten by Progressive. These guidelines will determine the company quoted, which may vary by state. The company quoted may not be the one with the lowest-priced policy available for the applicant. Certain Progressive companies may be compensated as licensed agencies for performing services on behalf of the Business Owners, General Liability, Professional Liability and Workers' Compensation insurers.

Progressive assumes no responsibility for the content or operation of the insurers' websites. Prices, coverages, privacy policies and compensation rates may vary among the insurers. There's no specific rule for how often you should or shouldn't change insurance companies, but it's a good idea to shop policies and rates every year around your renewal time. Even if you don't switch, you may be able to use new policy quotes as leverage for renegotiating rates with your current agent.

There are a number of reasons why you might change your agent while sticking with the same company. If you're considering changing, look into whether a new agent can service your existing policies. Depending on the type of insurance, even if new policies can save you money there might be other factors to consider.

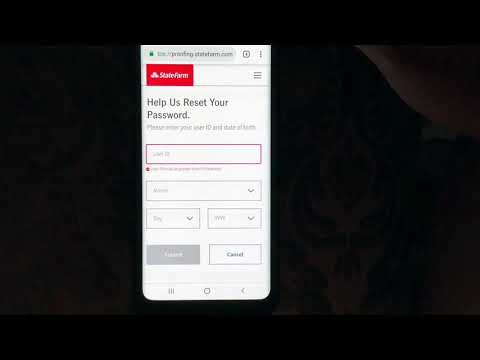

Life insurance policies, for example, often have exclusions that apply during the first two years that would apply again if you have to take out a new policy when changing agents. The bank opened in May 1999 and is operated by State Farm Financial Services, FSB, a subsidiary of State Farm Mutual Automobile Insurance Co. Home mortgages are available countrywide over the phone or through agents. From 2013 to 2015, State Farm fell behind its competitors on mobile (phone-based) services for auto policyholders, said Carney, who does a mobile functionality study each year.

But in 2017, State Farm's score on Forrester's study rebounded to 78.6 out of 100, slightly above the industry average. Forrester noted State Farm's improving mobile tools such as a depreciation calculator that helps customers avoid overpaying on coverage as their vehicles age. With that kind of support, I can affordably run my own business and focus on new sales growth. In fact, Brightway recently quantified what service after the sale means for their franchisees. In a nutshell, it means we, as Brightway agents, sell on average twice as much new business by our fourth year as compared to other independent agents. Those other independent agents aren't enjoying the benefits of a company that provides me with the greatest choice in carriers, superior support, the best technology and a nationally recognized brand.

We found that drivers with an excellent credit history received an average discount of 20% on annual car insurance rates compared to drivers with average credit history. The dispute, along with a number of other initiatives aimed at boosting competitiveness, could threaten State Farm's long-successful partnership with its agents. It also could sidetrack broader efforts to expand life insurance sales, introduce new services like variable annuities and online banking, and offer one-stop financial services. Insurance is a financial product people buy because they need it, not because they want it. The agent who sells and services your policy plays a large part in making sure the insurance fits your needs and your budget. You might need to change your agent at some point even if you want to keep your insurance.

An agent might retire, for example, or you might like the company but want a more attentive person to work with. Unless there's a change to your policy, simply switching agents with the same insurance won't get you a better price. Bank deposit and credit card products and services to State Farm customers.

Bank branches, ATMs and digital banking tools so you can bank how you want. Olny reason why we kept staying with State Farm was because her uncle worked there and her paranoid mom was afraid of some unknown insurance companies. We collected quotes across all 50 states and the District of Columbia for 37 insurance companies. Although 37 insurance companies were included in the analysis, insurance company rates were only included in our company lists if the company was one of the larger insurers nationally. Are a good starting point, but the only way to find the cheapest and best car insurance for you is to get quotes and shop around for options, either with your own research or by talking to an agent or broker. The cost of your policy will depend on how your profile fits the factors we've discussed.

Because of the increased likelihood that the car insurance company will have to pay out for a claim by insuring these drivers, they often charge young men more for coverage. Average annual car insurance costs can decrease significantly between the ages of 18 and 25, as insurers tend to evaluate older drivers as both less risky and likely to file a claim. Location is an important factor for auto insurance rates. Insurance is regulated at the state level, and even within a state, drivers in different ZIP codes can get different quotes. Compare average annual rates for the biggest auto insurers in the country based on online quotes for a 30-year-old driver. Because quotes vary for every individual, comparing rates is often the best way to find savings on car insurance.

Our analysis, based on hundreds of thousands of quotes collected nationwide, backs that up. We always recommend getting quotes from multiple auto insurers to find the best rate for you. From customized auto insurance to superior claims service, our people and technology will support you every step of the way.

Join us today and experience why we're one of the best insurance companies. State Farm will be leveraging Sales Cloud and Service Cloud with Financial Services Cloud to give agents the insights they need to service customers most effectively. The company uses captive agents, meaning that if you're interested in enrolling in coverage, you'll be directed to an insurance agent for help. Sometimes people don't really care for their agent, and that can lead to the desire to work with another company. State Farm said that, in Florida, it had paid out US$1.21 in claims for every dollar in premiums since 2000. Several other home insurers have pulled out of Florida as well; many homeowners are now using the Citizens Property Insurance Corporation run by the state government.

State Farm has since decided to remain in Florida, although with a reduced amount of property policies. In the 1950s, State Farm held a contest among the agents, to come up with ideas to expand the State Farm business. Robert H. Kent, a State Farm agent in Chicago, came up with the idea of providing auto loans to existing policyholders.

Robert H. Kent was friends with a local bank president at LaSalle NW, and the two teamed up to pilot the auto finance program. State Farm liked the idea so much that it was rolled out to all the agents. Robert H. Kent received royalties on the program for 20 years. This event created the first marketing partnership between insurance companies and banks.

Do not jump to Amica if that is the only other company you have investigated. Use an independent agant AND check out companies like GEICO and USAA, if eligible for the latter. Many reports of this forum of people saving money by switching from company A to company B.

At the same time, in a different area or different coverage, someone saves by switching from B to A. On top of the actual home that burnt down, fire victims also have to deal with cataloging and documenting all the contents of the home that were lost. When it comes to such personal property loss, Colorado law requires insurance companies cut a check for 30 percent of a homeowner's total coverage without requiring any documentation. Some insurers have written checks for as much as 75 percent, but not all of them. The Louisville neighborhood on Feb. 16, 2022 where Craig Swift, his wife and two kids lost their home in the Marshall Fire last December. They've been told that in order to file a homeowners insurance claim they must complete a detailed inventory of everything they lost in the blaze.

A builder told the couple it will cost around $850,000 to rebuild. Our rates for minimum-coverage policies represent the average cost of a policy that meets any state's minimum required auto insurance coverage. Who can help you find the best combination of price and fit.

You should be aware, however, that agents and brokers operate on commission paid by the insurers themselves. Independent agents work for multiple insurance companies and can compare among them, while captive agents work for only one insurance company. Drivers with good credit are considered lower risk by insurance companies and, as a result, can receive substantial savings on their auto insurance costs. Figure based on 2020 consumer data collected by Hagerty on single car quotes, with premiums $5000 and under, from several daily driver (or "Everyday") auto insurance carriers.

In November, State Farm also plans to launch State Farm Federal Savings Bank — its World Wide Web-based virtual bank. The venture, which will open initially to the insurer's agents, will eventually offer a full range of bank services — from home mortgages and conventional loans to checking and savings accounts. State Farm has also joined three Internet-based insurance shopping services. But instead of providing online quotes, like Allstate and Zurich Kemper Life Insurance Co., State Farm is parceling out leads to nearby agents who call prospects to provide quotes. The insurer hasn't made a decision about offering quotes online.

Some insurance can travel with you easily, but other types don't. You'll obviously need to change your homeowner's or renter's policy if you move. Car insurance can travel with you, but you'll need to change it if you move to a state where your current carrier isn't licensed. Even if the company is licensed in your new state, some of your policy terms and rates may change according to state laws and rates in your area.

Other policies, such as a life insurance plan you purchased outside of work, can usually travel with you without any issues. As you're planning your move, call your agent to discuss your options. If you are staying with the same carrier, you can switch agents at any time and transfer your policy to the new agent. If you're switching companies, you can usually cancel your policy at any time. However, some types of insurance policies can have cancellation fees.

Be sure to check your policy details before you switch carriers. In reality, it's not necessary to put up with bad customer service from a bad insurance agent. It's possible to switch insurance agents without affecting your current insurance policy. Some people stick with a bad insurance agent because they like their insurance rate with their current insurance carrier. They may be afraid they'll have to switch policies or have their rates changed.

Agents can't control the price of your policy, and changing only your servicing agent won't save you money. There are other ways in which finding a new agent at the same company might save you money. Different agents might arrive at different recommendations for how to protect your financial interests using insurance.